A Financial Plan Prepares You for a Downturn

By Generational Wealth Advisors

03/08/2020

In moments of market volatility, it’s easy to question whether or not you are adequately prepared for the changes. As a financial advisor, it’s our chief role to:

A) Create a plan to anticipate changes than you can control as well as anticipate the changes you cannot control (i.e. the market going down).

B) Help you follow your plan when the changes do come.

With worldwide markets trending downward (after the longest bull market run in all of history), we sometimes get questions in regard to whether or not changes should be made, when they should be made and how they should be made. The truth is, a poor market environment is one of the very first things we test for when we take a client through the financial planning process. Our Monte Carlo simulation creates two primary outputs.

1) Will my goals be funded if I retire during a ‘normal’ market?

2) Will my goals be funded if I retire during a ‘bad’ market

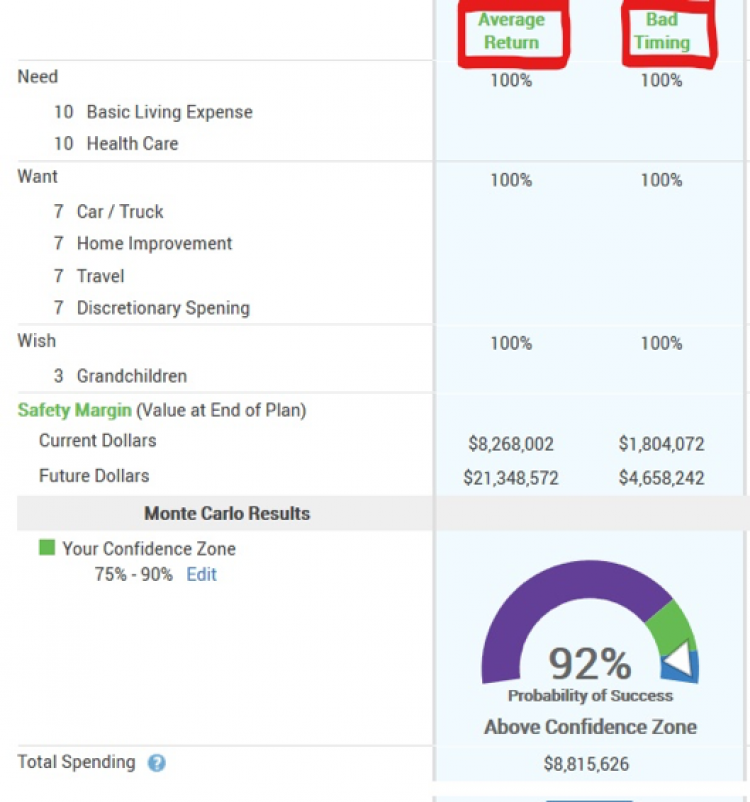

If you’ve gone through our process, you’ll be familiar with the screen shot below. We work hard on the front end to identify the Needs, Wants and Wishes you want to achieve while in retirement. We then seek to fund these goals during both normal markets and bad markets (I’ve highlighted the two scenarios in red).

In this example the client should expect to fully fund their retirement in both cases.

So, what exactly does “bad timing” mean when it comes to financial planning? In this case, the software recreates the client’s retirement plan as if they retired in 2007. Therefore, the first 2 years of retirement would include both withdrawals and portfolio losses. This has a long-term effect on the plan, but doesn’t mean you can’t retire.

We take this one step further. As your advisor, we begin to prepare you for retirement several years before that event. We begin moving your portfolio toward safe investments, so that if the stock market does turn negative, you don’t have to realize those losses. We begin to think through the most efficient ways to withdraw your money, to make sure you’re making the most of current and future tax positions. We structure your portfolio to maximize diversification and mitigate risk as much as possible.

While it’s hard to know what will happen in the coming weeks or months, stay focused on your long-term goals and objectives. We’re here to help with that.

Whether you’re selling your business, seeking wealth management advice, or just want more information on the latest state of the market, you can contact us to find out more.

All investing is subject to risk, including possible loss of principal.

About Generational

Generational Group, headquartered in Dallas, TX, is a leading, award winning full-service M&A advisory firm. Generational has over 300 professionals across 16 offices in North America. The firm empowers business owners to unlock the full value of their companies through a comprehensive suite of services—including strategic growth consulting, exit planning education, business valuation, value enhancement strategies, M&A advisory, digital solutions, and wealth management.

Celebrating its 20th year, Generational has successfully closed over 1,800 transactions and has ranked #1 or #2 in all LSEG league tables for deals valued between $25 million and $1 billion in 2022, 2023, and 2024.

The firm was named 2025 USA Investment Banking Firm of the Year by the Global M&A Network and recognized as Investment Banking Firm of the Year by The M&A Advisor in 2022, 2024 and 2025.