Generational Group Announces the Acquisition of Noblin & Associates by Noblin & Associates, LLC

By Generational Group

02/09/2016

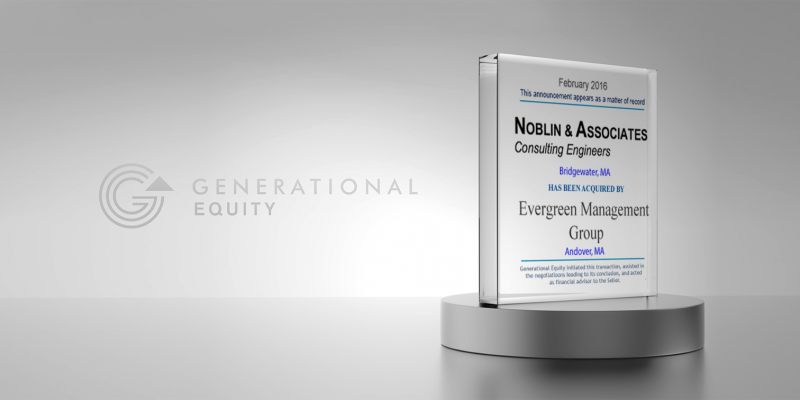

Generational Group, a leading mergers and acquisitions advisor for privately-held, middle-market businesses, is pleased to announce the acquisition of its client, Noblin & Associates, headquartered in Bridgewater, Massachusetts, by Noblin & Associates, LLC, headquartered in Andover, Massachusetts. The acquisition closed on February 1, 2016.

Noblin & Associates (Noblin) is a consulting engineering firm that specializes in envelope technology and the repair and restoration of buildings and structures. Learn more by visiting www.noblinassoc.com.

Managing Director Doug Smith, affiliate George Nova and Vice President Ryan Johnson led the Generational Group deal team that advised Noblin on the transaction.

“Initial contact with the buyer came from a Generational Group inquiry and the process from inquiry to close was per our scripted approach. Our associate, Samantha Mitchell kept things moving in the right direction with some negotiating help from her peers, leading to a very typical process from beginning to close,” stated Nova.

“Both parties had similar interests and it became obvious immediately that it would happen. While negotiations on valuation and structure at times became a bit strained, the deal closed because both parties got what they wanted.”

About Generational

Generational Group, headquartered in Dallas, TX, is a leading, award winning full-service M&A advisory firm. Generational has over 300 professionals across 16 offices in North America. The firm empowers business owners to unlock the full value of their companies through a comprehensive suite of services—including strategic growth consulting, exit planning education, business valuation, value enhancement strategies, M&A advisory, digital solutions, and wealth management.

Celebrating its 20th year, Generational has successfully closed over 1,800 transactions and has ranked #1 or #2 in all LSEG league tables for deals valued between $25 million and $1 billion in 2022, 2023, and 2024.

The firm was named 2025 USA Investment Banking Firm of the Year by the Global M&A Network and recognized as Investment Banking Firm of the Year by The M&A Advisor in 2022, 2024 and 2025.