A Financial Plan Prepares You for a Downturn

By Generational Wealth Advisors

03/08/2020

In moments of market volatility, it’s easy to question whether or not you are adequately prepared for the changes. As a financial advisor, it’s our chief role to:

A) Create a plan to anticipate changes than you can control as well as anticipate the changes you cannot control (i.e. the market going down).

B) Help you follow your plan when the changes do come.

With worldwide markets trending downward (after the longest bull market run in all of history), we sometimes get questions in regard to whether or not changes should be made, when they should be made and how they should be made. The truth is, a poor market environment is one of the very first things we test for when we take a client through the financial planning process. Our Monte Carlo simulation creates two primary outputs.

1) Will my goals be funded if I retire during a ‘normal’ market?

2) Will my goals be funded if I retire during a ‘bad’ market

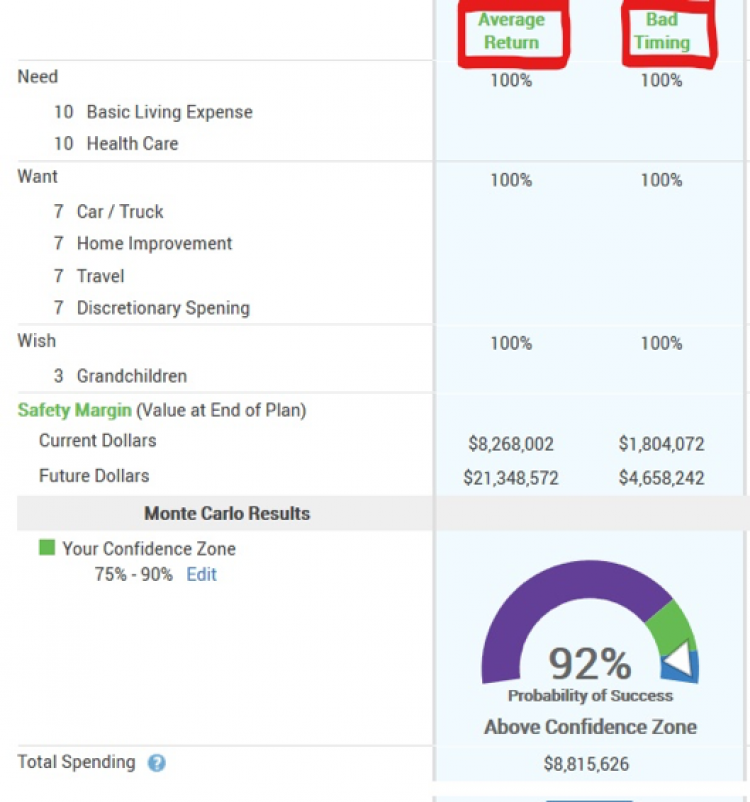

If you’ve gone through our process, you’ll be familiar with the screen shot below. We work hard on the front end to identify the Needs, Wants and Wishes you want to achieve while in retirement. We then seek to fund these goals during both normal markets and bad markets (I’ve highlighted the two scenarios in red).

In this example the client should expect to fully fund their retirement in both cases.

So, what exactly does “bad timing” mean when it comes to financial planning? In this case, the software recreates the client’s retirement plan as if they retired in 2007. Therefore, the first 2 years of retirement would include both withdrawals and portfolio losses. This has a long-term effect on the plan, but doesn’t mean you can’t retire.

We take this one step further. As your advisor, we begin to prepare you for retirement several years before that event. We begin moving your portfolio toward safe investments, so that if the stock market does turn negative, you don’t have to realize those losses. We begin to think through the most efficient ways to withdraw your money, to make sure you’re making the most of current and future tax positions. We structure your portfolio to maximize diversification and mitigate risk as much as possible.

While it’s hard to know what will happen in the coming weeks or months, stay focused on your long-term goals and objectives. We’re here to help with that.

Whether you’re selling your business, seeking wealth management advice, or just want more information on the latest state of the market, you can contact us to find out more.

All investing is subject to risk, including possible loss of principal.

About Generational

Headquartered in Dallas, Generational is one of the leading M&A advisory firms in North America.

With more than 350 professionals located throughout 17 offices in North America, the companies help business owners release the wealth of their business by providing growth consulting, merger, acquisition, and wealth management services. Their six-step approach features strategic and tactical growth consulting, exit planning education, business valuation, value enhancement strategies, M&A transactional services, and wealth management.

The M&A Advisor named the company Investment Banking Firm of the Year three years in a row, Valuation Firm of the Year in 2020, and North American Investment Bank of the Year in 2022 as well as Consulting Firm of the Year. For more information, visit https://www.generational.com.